How Does The Canada Dental Benefit Work?

With the announcement of the new Canada Dental Benefit, you may have some questions about how the program works. We have included a guide that will help you find some of the answers you are looking for. We are also available to help walk you through the program as well. Please fill out the contact form below if you have any more questions or would like to book an appointment to take advantage of this program for your child.

What You Need to Know

Q1. Who is eligible to receive the interim Canada Dental Benefit?

To be eligible, families need to meet all of the following conditions for each child they apply for:

Have a child under 12 years of age who does not have access to private dental care coverage (employer-based or purchased through the applicant or other family member);

Have an adjusted family net income under $90,000 per year;

Have filed last year’s income tax and benefit return (for the taxation year 2021, to be eligible in 2022—for more information on how to file a return, visit Canada.ca/doing-your-taxes);

Be the parent (or legal guardian) who receives the Canada Child Benefit for that child;

Have incurred—or will incur—out of pocket costs for the dental care of the eligible child which have not been fully reimbursed under another federal, provincial or territorial government program; and

Provide information on the recent or planned oral health care visit that the benefit would be used to pay for, along with information about the oral health care provider.

Q2. What constitutes the definition of a child under 12? As of what date?

Eligible children need to be 11 years old or under as of December 1, 2022, for the first year of the benefit, and 11 years old or under as of July 1, 2023, for the second year of the benefit.

Q3. What types of dental care are covered by the Canada Dental Benefit?

The Canada Dental Benefit can be used for any oral health care provided by a regulated oral health professional licensed to practice in the place where care is provided.

Q4. How much money do eligible families receive?

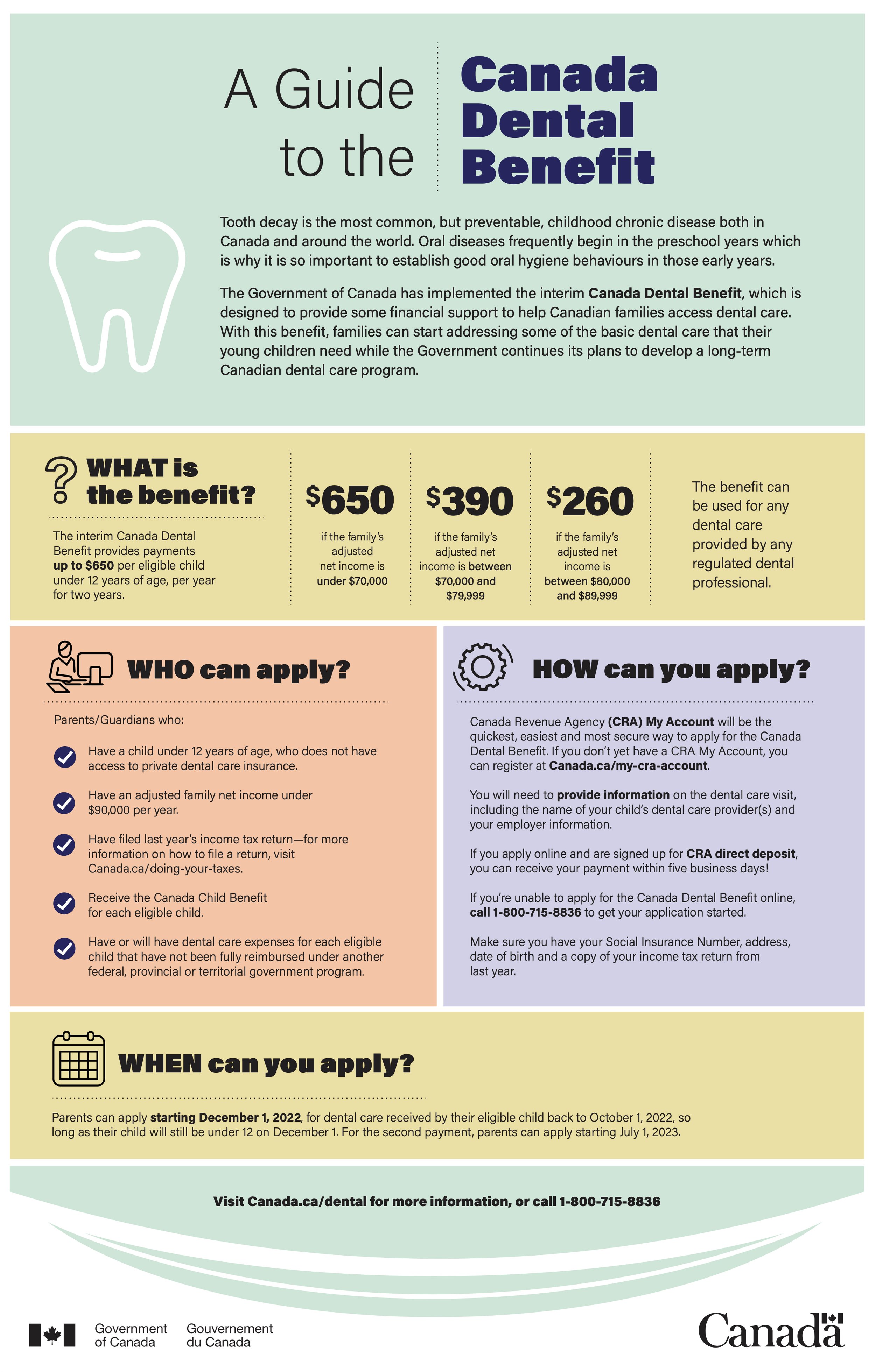

The interim Canada Dental Benefit provides payments up to $650 per child under 12, per year for two years, for families with an adjusted net income under $90,000 per year.

$650 is provided for each eligible child, per year, if the family’s adjusted net income is under $70,000.

$390 is provided for each eligible child, per year, if the family’s adjusted net income is between $70,000 and $79,999.

$260 is provided for each eligible child, per year, if the family’s adjusted net income is between $80,000 and $89,999.

Q5. Is the Canada Dental Benefit taxable?

No, the benefit is tax-free.

Q6. Would receiving the interim Canada Dental Benefit reduce any other federal income- tested benefits such as the Canada Workers Benefit, the Canada Child Benefit, or the GST Credit?

No, the benefit will not reduce other federal benefits.

Q7. Will applicants covered by provincial or territorial programs be eligible?

Yes. We know that provincial and territorial programs do not cover dental care needs for children under 12 equally across Canada, and that in some cases, the programs focus only on emergency needs. Children under 12 who are currently covered by provincial or territorial programs will still be eligible for the interim Canada Dental Benefit so long as they are incurring out of pocket costs for dental care services – costs which are not reimbursed under another federal, provincial or territorial government program – and if their family meets all of the criteria to qualify for the benefit.

However, families whose needs are met by their provincial or territorial programs and don’t have out-of-pocket costs are not eligible for the benefit and should not apply.

Q8. Will applicants covered by the Non-Insured Health Benefits program be eligible?

Yes. Children under 12 covered by Non-Insured Health Benefits (NIHB) continue to be covered by the robust dental coverage available to them under that program. Parents covered by NIHB are eligible to apply for their children under 12 if they meet all of the other criteria for the benefit and are incurring out of pocket costs for dental care services that are not reimbursed by a federal, provincial or territorial government program. However, we anticipate that in most cases, NIHB will meet their needs and they will not have out-of-pocket expenses for their dental care.

Applicants must have out-of-pocket expenses that are not fully reimbursed by any other federal, provincial or territorial government program in order to be eligible for the Canada Dental Benefit.

Q9. When can families apply for this benefit? Will applicants be able to apply for dental care costs retroactively?

Applications opened for the interim Canada Dental Benefit on December 1, 2022. The benefit will cover dental care expenses retroactive to October 1, 2022, for qualifying children and families who were eligible as of the December 1, 2022. For the second benefit period, applications will be opened on July 1, 2023.

Q10. What if I do not have access to the Internet? How can I apply?

Eligible families who are unable to access the Internet can apply for the Canada Dental Benefit through CRA’s client contact centre at 1-800-715-8836.

Q11. How can families or individuals who do not file income taxes, or do not receive the Canada Child Benefit, or cannot provide an address for their oral health professional (as is the case for many vulnerable populations), receive the interim Canada Dental Benefit?

To receive the Canada Dental Benefit, applicants will need to make sure they have filed the previous year’s income tax (e.g. 2021 tax return for the first benefit year) and currently receive the Canada Child Benefit (CCB) for their eligible child. Filing taxes is easy with the Community Volunteer Income Tax Program (if eligible) or through NETFILE-certified software. They can also file online through the services of an electronic filer certified to use our EFILE service.

If applicants are unable to apply for these new programs online, they can call the CRA and complete their application over the phone with an agent. Before calling, applicants should check the approximate wait times on Canada.ca. To validate their identity, applicants should make sure they have their social insurance number address, date of birth, and a copy of their assessed tax return from last year on hand for the CRA agent.

Q12. Who is responsible for processing the payments and how quickly can applicants expect to receive the money?

CRA’s My Account is a quick, easy and secure way to apply. In order to receive this benefit, parents/guardians must also be in receipt of the Canada Child Benefit. As a result, many applicants may already be familiar with My Account. Most applicants can expect to receive their payments within 5 business days if they are enrolled for direct deposit, and within 10-12 business days if they are receiving a cheque by mail.

Need to enroll for direct deposit? Follow the steps outlined on Canada.ca.

Q13. How will applicants’ eligibility be verified?

The CRA will use its full suite of existing compliance tools to verify an applicant’s identity and eligibility, including an up-front verification of the applicant’s income, child’s age and family relationship, and confirmation that they are in receipt of the Canada Child Benefit for the presence and age of children. Applicants will be asked to save the receipts for that child. When applying, parents or guardians of eligible children will need to attest that:

the child does not have access to private dental care coverage;

the child has received, or will receive, dental care services between October 1, 2022 and June 30, 2023. Parents and guardians must keep their dental receipts for 6 years in case the CRA contacts them in the future to validate eligibility. Applicants that are found to be ineligible for the benefit during the verification processes will be will be required to repay the benefit they received.

Q14. How can applicants get ready to apply for the Canada Dental Benefit?

Canadians should sign up for CRA My Account and direct deposit, ensure they have applied for or currently receive the Canada child benefit, file the previous year’s income tax return if they have not already done so, and update their address and banking information if it has changed.